The number of international students enrolled at institutions in Australia is largely back to pre-pandemic level, hitting some 683,000 in May 2023, but it remains unclear whether the country is heading towards a boom, analysts have said.

In a key data update, Study Move analysed the sustainability of prevailing market conditions in the months ahead, following what it describes as months of favourable market conditions.

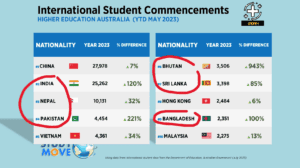

Data from the department of education in Australia shows that international commencements in higher education have risen to 105,000 in the year to May 2023, an increase of 9% on 2019 figures.

“I don’t think we have reached the point of [rapid and significant growth] yet. We have seen rapid and significant growth in the number of students coming in, but when you really see the complete picture of the whole revenue and enrolments, we haven’t even reached growth,” Keri Ramirez at Study Move said.

“We are still in recovery mode… It’s very early to say that we are heading towards a boom, but we are experiencing a speedy and extraordinary recovery of the international education sector in Australia.”

Writing online, senior economist at Austrade, Fernando Ramirez, highlighted that source markets for students has largely shifted away from China.

After a drop of 170,000 international student enrolments in 2022 compared to 2019, educational institutions faced “immense financial strain”, but it is “likely that the growth of international students will continue”, he said.

Study Move also pointed out that commencement from China are now 64% for postgraduate programs, compared to the 51% being the same in 2019.

An increase in ELICOS enrolments mean higher education enrolments “are likely to rise in the near future” as the courses provide pathways to university-level studies, the Austrade economist added.

The ELICOS sector has seen its main source country move away from China to Colombia as the main contributor of students. China is now the fourth largest source of ELICOS enrolments.

“There is not a single market that can replace China, which contributed more than 200,000 international student enrolments in 2019,” he added.

It is regrettable that there are fewer Chinese students, due to both the loss in fees they contribute, as well as the wealth of knowledge and skills, cultural diversity and the bridges that “form valuable relationships” they bring.

With a decline of some 59,000 Chinese students overall, Colombia (14,690), India (14,650), the Philippines (13,110), Nepal (10,340), Thailand (9,240), Pakistan (7,590) and Bhutan (5,980) have all seen growth, Fernando Ramirez said.

Study Move also highlighted the higher education growth in similar markets, pointing to 120% growth from India, 221% from Pakistan and 943% growth in Bhutan, although the latter two are from a lower base.

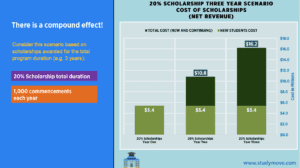

The education data provider also noted that the role of scholarships is changing, with more Australian institutions offering scholarships or fee waivers during the pandemic. Currently, 33 universities in the country are offering scholarships internationally.

There is a cost to revenue, Ramirez at Study Move emphasised. Using data collected since 2017, he said that it is a story of “text book micro-economics of what happens when many players start discounting their prices”.

Traditionally scholarships had been used to attract talent and for equity purposes, but very few institutions had utilised them as a discounting mechanism to be more competitive and increase marketshare, he said.

“When many are following that strategy, it becomes diluted”

“During Covid, we saw that the majority of universities jumped on to the scholarships bandwagon… [as a result of] emergencies and uncertainties but also the scholarships were to compensate students that were unable to have that on-campus experience,” he explained.

“The more players that are discounting, the less affects the discounting will be for efforts to increase marketshare,” he continued.

“When many are following that strategy, it becomes diluted… You think about a student who has five offers all with 20% scholarship, there is no competitive advantage. The one that is winning is the student of course… but from a competitive view and advantage it really dilutes and fades away. It’s interesting to see where we are heading.”

Between 20 universities in Australia are offering 20-25% reduction in fees, he said, adding that institutions are beginning to reevaluate how to utilise scholarships in their strategies.

For an average institution with 1,000 commencements offering fees of $36,000, if it offers three of four students a 20% discount, it will see a cost of $5.4m in revenue in one year, with a compound affect for each year.

Unlike many universities in New Zealand, Australian institutions are offering scholarships for the full length of the programs. Photo: Study Move

“[Estimates suggest] the cost of commission to agents and scholarships is around 25-30% of revenue from new students. Is it high or low? I’ll let you decide,” he said. “Now we that are far away from Covid… it seems that it is logical to start reviewing scholarship programs.”